Paying your Property Tax “Predial” in Mexico

January in Mexico is more than pleasant weather. It is the time to pay property taxes to receive a discount. Mexican property taxes are known as predial, and like most places these taxes are used to operate local governments. As north of the US-Mexican border, there is a discount for paying the entire tax early; here we pay by the end of February to be eligible for a ten percent discount. This said, it is sometimes easier to say than to do. In Mexico property tax statements are not sent out in the mail; nor are they available electronically. One must go to the local city hall. Go either to the city hall in Chapala, Jocotepec or San Luis Soyotlan with your property account number. In Jocotepec one goes to the Tesoro office, which is across the Plaza from the Delegacion. Property tax files are recorded by number, not name, although one should check the records to make certain that the correct name is associated with the property.

- Paying the Predial at the main office

- Example of Property Tax in hand

Procedure for paying your Predial in Ajijic and Lake Chapala Mexico:

First find your property account number, which is located on the previous year’s property tax statement or in the land deed.

The second step is to go to the appropriate city hall with cash in hand. Take a number or queue in line, depending on which municipality. For the sake of simplicity, I´ll go through the steps for Ajijic.

The taxpayer goes to the Chapala Municipality with the account number. On the ground floor there are several windows, sort of like going into a bank. Go early in the day to the window area directly across the building entrance and a little to your left. Take a number from the machine and wait your turn. Hold onto the number because it tracks the process all the way and you will need to show it again. Do pay attention to the numbers as they are flashed. The screen will tell what number (the one in your hand) and which numbered window to go to in order to receive the amount due for your current property tax bill.

When arriving at the designated window, you give the attendant your property tax account number. If you do not speak Spanish, just show the clerk your previous tax statement, and she will look up your account and print you a relevant copy. The next step is across the foyer where you wait in a second line. You will need the same number you received before going to the first window because that is how you will be called to pay your bill.

- Paying the Property Tax Predial at the Municipality

- Example of Property Tax PAGADO stamp

Sometimes people need to go the bank, or wherever. If you do this, you need to get another number when you return and wait in the first line again in order to show the clerk your current tax statement with your tax ID Number, because the clerk electronically sends your account information to the cashier across the room.

Pay the tax, cash only, and the clerk will stamp your current statement as Pagado. Keep this paid property tax statement in your file because when you sell your home, you will need to provide proof that all property taxes are current. Also, by bringing your paid statement with you when you pay tax the next year, the account will be easier to identify.

In an earlier article I talked about the necessity for using a notary when you buy property in order to make certain that the seller has clear title and that property taxes are current. If the property taxes are not current, there will be a penalty of up to three times the original tax amount. Because the tax statement is not sent, many people do not realize the procedure for going to the appropriate city hall to pay. That is one reason property owners often hire a local property manager. The manager is responsible for paying all bills including property taxes, association fees, as well as utilities and household help. Overall, the monthly charges for hiring a property manager are miniscule compared to paying delinquent taxes or having utilities shut off for non-payment.

Can a Foreigner buy Real Estate in Mexico (Notary and Properties)?

In an on line publication, Latin World, it stated:

“The property tax rate in Mexico may range from 0.275% to 1.350% depending on the location of the property. Regardless of the property location, property taxes are lower than those in the US.”

- Example of Property Tax Receipt

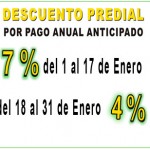

- Discounts on Predial

Further research said a home here in Ajijic Mexico valued in the $300,000 USD range had a property tax of $2,300 pesos or a little less than $200 USD for a full year. The property taxes in the US on a similar property far exceeded this amount.

The procedure can sometimes require more than one day. Once I was in Guadalajara and there was a line going around the block. I asked what the long line was for and someone explained that they were all waiting in line to pay their property taxes before the deadline. Since it was already afternoon, I am not sure everyone got in that day. The lesson here is not to wait until the end of February to pay your property taxes. The only thing is that sometimes the current property tax statements are not ready until sometime in February. At least here at Lakeside our property bills are usually ready by the last week of January.

It’s a bargain. Enjoy your property.

/

/  Aviso: Nuestro sitio web se puede leer en inglés y español y la moneda también puede ser en pesos MXN o dólares USD. Desplácese hasta la parte superior de nuestro sitio web para seleccionar su idioma y moneda. Our website can be read in English & Spanish and the currency can also be in MXN pesos or USD dollars. Please scroll to the top of our website to select your language & currency .

Aviso: Nuestro sitio web se puede leer en inglés y español y la moneda también puede ser en pesos MXN o dólares USD. Desplácese hasta la parte superior de nuestro sitio web para seleccionar su idioma y moneda. Our website can be read in English & Spanish and the currency can also be in MXN pesos or USD dollars. Please scroll to the top of our website to select your language & currency .